- Corn ¼ to ½ lower

- Soybeans 1 ½ higher to 1 ¼ lower

- Wheat ¼ to ¾ lower

- Basis Flat/Lower

- Live Cattle 155 lower (233.73)

- Lean Hogs 175 lower (360.73)

- Dow Jones 233 higher (49,726)

- Crude Oil 136 higher (59.12)

The positive week ended quietly with markets drifting on both sides of unchanged in a low volume trade as both speculators and hedgers got positioned ahead of Monday’s major USDA report. News remains consistent with non-threatening weather in South America and just enough Chinese bean buying to keep the bull’s attention but not enough to produce a meaningful rally. The USDA/WASDE numbers will set a baseline for US and world trade to work with as Brazil’s bean harvest starts in earnest this week while US farmers and bankers work through the mix of what the US farmer will be planting this spring.

News and Notes:

- SA weather for the next 2-weeks remains non-threatening with dry conditions in place for the start of Brazil’s most northern bean harvest with a healthy mix of rain, sun, and normal temperatures for the developing crops in southern Brazil and Argentina. Record yield potential has been cited in all public and private crop estimates in both countries as minimal crop stress has been experienced in the southern hemisphere this growing season. SA is on pace for their third straight record total yields.

- The daily new crop charts are on Page 2 and show this week’s modest bounces back into the middle of the trading range for corn while beans and wheat are struggling to mount any bounce from the lower ends of their ranges. The large bean fund length heading in Brazil’s harvest is major concern.

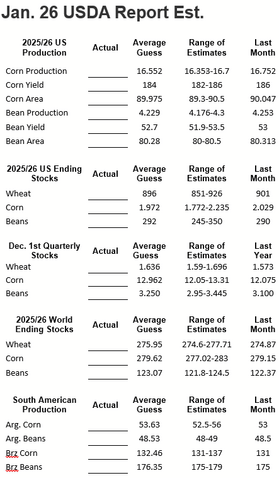

- The USDA pre-report estimate chart is below and shows the modest yield cuts (2 BPA for corn and .3 for beans) that will be a big focus when the report is released. Other areas of interest will be how much the USDA increases the potential crop size for both corn and beans for Brazil and Argentina and how the USDA addresses the missing 450 MBU+ of missing Chinese bean purchases due to the trade war. One rumored concern is the low silage harvest which could increase harvested corn acres 700,000-900,000 and add 140-150 MBU to US corn ending stocks. Unless the USDA makes a major cut in US corn and bean yield, it is hard to see the report having a long-tern bullish impact on prices.

- The military takeover of Venezuela by the US last weekend did not upset the energy markets very much with crude still stuck between $56-$60 a barrel. The diesel and crude charts could be interpreted to have had a mini-breakout last week, so filling up your fuel tanks for the spring and booking some summer needs on your diesel is recommended.

- Weekly Changes: Corn +8 1/4 (March ‘26), +5 1/2 (Dec ‘26), Beans +16 (May ‘26), +13 1/2 (Nov ‘26), Wheat +9 3/4 (July ’26), Crude +180, Diesel +199, Dow +1110, US Dollar +732, Cattle -227, Feeder Cattle +463, Hogs +120, Cotton +40, Milk -21 (14.86).

Whatever I write in this comment will probably be irrelevant after Monday’s 11am CT USDA report release. The January report is the biggest report of the winter (August is the biggest of the summer) and the USDA and WASDE will update every column on their spreadsheets from the 2025 “final” yields to the expected size of the South American crops. Demand is always a moving target but with negative adjustments expected for US exports in beans and increased harvested acres for corn, the general thought is that the USDA will have a hard time cutting yield enough to offset those bearish adjustments. Please put in overhead old and new crop sales targets with your buyers if we do get a bullish surprise to take advantage any post-report rally, as the calendar turns bearish in the weeks to come as Brazil’s bean harvest gets serious. Opening calls are mixed with a dull trade expected until the USDA releases the report. Have a great Sunday.

December 2026 Corn – Daily

November 2026 Beans – Daily

July 2026 Wheat – Daily

USDA January 12th Report Estimates

Sales Targets

- 2024 Crop Finished Finished Finished

- 100% Sold at $4.46 Avg 100% Sold at $11.13 Avg 100% Sold at $6.20 Avg

- 2025 Crop 10% at $4.58 – March ‘26 Finished Finished

- 70% Sold at $4.45 Avg 100% Sold at $10.67 100% Sold at $6.24 Avg

- Current Price $4.46

- 2026 Crop 10% at $4.80 - Dec '26 10% at $11.40 – Nov ‘26 On Hold– July ‘26

- 30% Sold at $4.72 35% Sold at $10.96 50% Sold at $6.13

- Current Price $4.64 $10.72 $5.41

%’s are total of expected yields. Bold Prices are Updated Sales Targets. * price includes trading

Previous Sales Levels

-

2024 Sales Sales

May ’25 $4.41 (25% on 9-6-24)

May ’25 $4.55 (25% on 10-1-24)

May ’25 $4.45 (25% on 11-7-24)

May ’25 $4.50 (15% on 12-10-24)

Dec ’25 $4.30 (10% on 9-15-25)Nov ’24 $12.20 (25% on 5-22-24)

May ’25 $10.56 (25% on 9-3-24)

May ’25 $10.80 (25% on 9-23-24)

May ’25 $10.90 (25% on 9-24-24)July ’24 $6.60 (15% on 12-6-23)

July ’24 $6.35 (15% on 5-6-24)

July ’24 $6.65 (15% on 5-10-24)

Dec ’24 $5.80 (20% at 9-4-24)

Dec ’24 $5.95 (20% on 9-13-24)

Dec ’24 $6.10 (15% on 10-2-24) -

2025 Sales Sales

Dec ’25 $4.45 (25% on 11-7-24)

Dec ’25 $4.42 (25% on 12-11-24)

Mar ’26 $4.50 (10% on 10-28-25)

Mar ’26 $4.50 (10% on 12-12-25)Nov ’25 $10.60 (25% on 9-3-24)

Nov ’25 $10.90 (25% on 9-24-24)

Nov ’25 $10.25 (15% on 1-2-25)

Nov ’25 $10.55 (10% on 8-22-25)

Nov ’25 $10.52 (15% on 10-27-25)

Mar ’26 $11.05 (10% on 10-28-25)July ’25 $7.50 (20% on 5-22-24)

July ’25 $6.35 (25% on 10-1-24)

July ’25 $5.95 (15% on 2-3-25)

Sep ’25 $5.90 (20% on 6-20-25)

Dec ’25 $5.40 (20% on 7-3-25) -

2026 Sales Sales

Dec ’26 $4.75 (10% on 6-20-25)

Dec ’26 $4.70 (10% on 11-14-25)

Dec ’26 $4.70 (10% on 12-2-25)Nov ’26 $10.75 (15% on 8 21-25)

Nov ’26 $10.95 (10% on 10-27-25)

Nov ’26 $11.30 (10% on 12-2-25)July ’26 $6.45 (25% on 6-20-25)

July ’26 $5.80 (25% on 11-4-25)

Today’s Market Closes — Rounded to the Nearest Cent

- March $4.46

- May $4.54

- July $4.60

- Dec ‘26 $4.64

- January $10.49

- May $10.75

- July $10.88

- November $10.72

- March $5.17

- May $5.29

- July $5.41

- Dec ‘26 $5.73

- Feb Diesel 2.1350 +155

- US Dollar 98.890 +202

- Cash Cattle $236 Trade

- Lean Hogs 85.30 -58

A Complete Overview of Current New Crop Market Conditions

Last Updated: 01/11/2026

- Corn Neutral Neutral Neutral Neut/Bearish High Sell Rallies

- Soybeans Bearish Bearish Neut/Bearish Bearish High Sell Rallies

- Wheat Neutral Neut/Bearish Neutral Neut/Bearish High Sell Rallies

- Cattle Neut/Bullish Bullish Neut/Bullish Neutral High Sell Rallies

- Hogs Neutral Neut/Bullish Neutral Neutral High Sell Rallies

- Diesel Neut/Bearish Neut/Bearish Neutral Neut/Bearish High None

- Denotes positive change

- Denotes negative change

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. No market data or other information is warranted by Reliance Capital Markets II LLC as to completeness or accuracy, express or implied, and is subject to change without notice. Any comments or statements made herein do not necessarily reflect those of Reliance Capital Markets II LLC, or their respective subsidiaries, affiliates, officers or employees. Disclaimer: Past performance is not indicative of future results. Strategic Trading Advisors is a registered DBA of Reliance Capital Markets ll LLC.

About Jody Lawrence

Jody Lawrence has been in the commodity brokerage and agriculture marketing business since 1992 and started Strategic Trading Advisors in 1999 and runs it today with his son Brady. The daily market comment his company publishes has over 7000 subscribers in 33 states and 3 countries and provides a concise overview of the world markets with ideas on farm hedging and marketing. Jody also travels the country giving 60-70 marketing meetings a year through his 22-year strategic partnership with Helena Agri-Enterprises.

About Brady Lawrence

Brady Lawrence is an Agriculture Market Specialist and Financial Advisor that focuses on commodities markets, futures and options brokerage, and helping individuals and families plan for retirement and their financial futures. Brady joined Jody at Strategic Trading Advisors in 2018 after college and supports the market research and brokerage sides of the business.