- Corn 6 ¼ to 3 higher

- Soybeans 13 ¼ to 6 higher

- Wheat ¼ lower to ¼ higher

- Basis Flat

- Live Cattle 628 lower (219.00)

- Lean Hogs 203 lower (337.00)

- Dow Jones 855 lower (47,508)

- Crude Oil 19 higher (58.68)

Corn and beans charged higher through technical resistance and moved to new 15-month highs closes while wheat was flat. Outside markets saw nasty selloffs with cattle being pressured by more potential political intervention while the US and world stock markets were pummeled by valuation concerns and technical weakness. The disparity of market directions both inside and outside the ag markets is difficult to navigate and when the first major USDA report in months is going to be released on Friday, the volatility could be even wilder after the report is released. Yield cuts are expected; it is just a matter of if the USDA will cut them enough to help justify the sharp gains in beans and corn over the last month.

News and Notes:

- Non-threatening forecasts for Argentina and Brazil remain the trend into month end with US weather warming into the Thanksgiving break. Despite the old and new crop rallies, the weather is not one of the legs of support drawing in buyers.

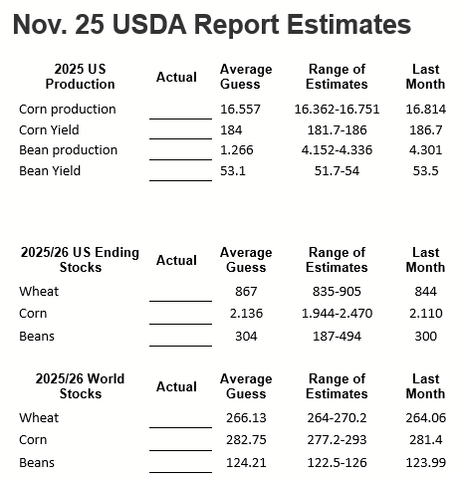

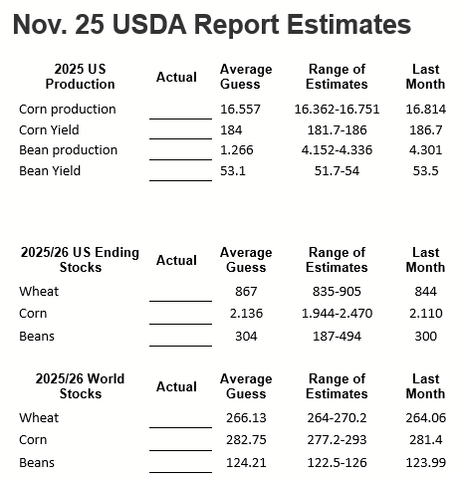

- The private estimates for Friday’s USDA report are on Page 2, and the biggest numbers will be corn and bean yield. Corn and bean yield cuts are priced into the market at current levels, but the question is will the USDA match the 184 and 53.1 average estimate. Further fundamental bullishness in corn would need a cut below 182 with beans cut under 52 needed. Chinese demand (or lack thereof) in beans will also be closely watched as the USDA may be forced to add several hundred million bushels to ending stocks due to the downward export expectations for China. Trading in the fog of missing reports has not been awful, but it has been frustrating because the USDA report will decide trade direction into the end of the month whether the numbers are up to date or just quickly assembled over the last few days.Without official state signatures on the Chinese/US trade deal, the USDA is NOT allowed to include those numbers in any official report.

- The US government re-opened today with a schedule of weekly export releases and todays was for the week of September 25thand showed the slow pace seen before the shutdown. The USDA will take a more measured pace on releasing export and CFTC data in the months ahead. After Friday’s USDA report, the entire agency will concentrate on catching up and have all the appropriate data assembled for the January Final 2025 Yield and Stocks Report.

- Cattle were spooked by more comments from President Trump about lowering tariffs on Brazilian beef imports and fell sharply for the second straight day. The losses of the last three days have wiped out Monday’s limit up gains to further whiplash any end user or rancher trying to take a position in this market. Today’s lows ($218.25) tested last Thursday’s four-month lows, with only the 200-DMA $3.45 below the market for technical support. Expect more ridiculous volatility.

- Please take a few minutes before Friday’s USDA report to listen to our 103rdedition of the FieldLink podcast entitled “Innovation Never Stops”.

The November USDA/WASDE report is normally a rather ho-hum affair but in light of the longest government shutdown in history and the USDA only having 10-days to prepare their mountains of data, tomorrow’s report could show anything. Expectations are for drought and rust related yield cuts, it is just a matter of how efficiently the USDA has been able to process the data. Social media and trader talk is inconsistent if this could be a buy the rumor sell the fact event, or if President Trump’s political pressure will be a factor in the estimates. The administration wants to help soybean farmers with higher prices but wants to lower beef prices to help inflationary food trends. Bi-polar may be a good description of the current plan toward the ag sector by this administration. The report will be out at 11 am cdt and we will put out an overview shortly after the release to highlight the new data.

Sales Targets

- 2024 Crop Finished Finished Finished

- 100% Sold at $4.46 Avg 100% Sold at $11.13 Avg 100% Sold at $6.20 Avg

- 2025 Crop 10% at $4.58 – March ‘26 Finished Finished

- 60% Sold at $4.45 Avg* 100% Sold at $10.67 100% Sold at $6.24 Avg

- Current Price $4.56

- 2026 Crop 10% at $4.70 - Dec ‘26 10% at $11.40 – Nov ‘26 On Hold– July ‘26

- 10% Sold at $4.75 25% Sold at $10.80 50% Sold at $6.13

- Current Price $4.73 $11.22 $5.75

%’s are total of expected yields. Bold Prices are Updated Sales Targets. * price includes trading

November USDA Pre-Report Estimates

Today’s Market Closes — Rounded to the Nearest Cent

- December $4.42

- March $4.56

- July $4.69

- Dec ‘26 $4.73

- January $11.47

- May $11.66

- July $11.73

- November $11.22

- December $5.36

- March $5.52

- July $5.75

- Dec ‘26 $6.06

- Dec Diesel 2.4657 -339

- US Dollar 99.035 -339

- Cash Cattle $232 Offer

- Lean Hogs 78.08 -255

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. No market data or other information is warranted by Reliance Capital Markets II LLC as to completeness or accuracy, express or implied, and is subject to change without notice. Any comments or statements made herein do not necessarily reflect those of Reliance Capital Markets II LLC, or their respective subsidiaries, affiliates, officers or employees. Disclaimer: Past performance is not indicative of future results. Strategic Trading Advisors is a registered DBA of Reliance Capital Markets ll LLC.

About Jody Lawrence

Jody Lawrence has been in the commodity brokerage and agriculture marketing business since 1992 and started Strategic Trading Advisors in 1999 and runs it today with his son Brady. The daily market comment his company publishes has over 7000 subscribers in 33 states and 3 countries and provides a concise overview of the world markets with ideas on farm hedging and marketing. Jody also travels the country giving 60-70 marketing meetings a year through his 22-year strategic partnership with Helena Agri-Enterprises.

About Brady Lawrence

Brady Lawrence is an Agriculture Market Specialist and Financial Advisor that focuses on commodities markets, futures and options brokerage, and helping individuals and families plan for retirement and their financial futures. Brady joined Jody at Strategic Trading Advisors in 2018 after college and supports the market research and brokerage sides of the business.