test

Today’s Market Closes — Rounded to the Nearest Cent

- c1 c2

- b1 b2

- w1 w2

- o1 o2

- Corn 5 ¼ to 1 ¾ higher

- Soybeans ½ to 1 ¾ higher

- Wheat 7 ½ to 9 ½ lower

- Basis Flats

- Live Cattle 8 higher (227.08)

- Lean Hogs 100 higher (108.20)

- Dow Jones 137 higher (42,917)

- Crude Oil 54 lower (64.77)

Previous Sales Levels

-

2023 Sales

c

c1

c2b

w

Sales Targets

Last Updated: 08/28/2025

New Sales Targets for 2026 Corn

- t1 c1 b1 w1

- t2 c2 b2 w2

- t3 c3 b3 w3

- t4 c4 b4 w4

- t5 c5 b5 w5

- t6 c6 b6 w6

%’s are total of expected yields. Bold Prices are Updated Sales Targets. * price includes trading

December Corn – Daily Funds Short 660 MBU

First Glance

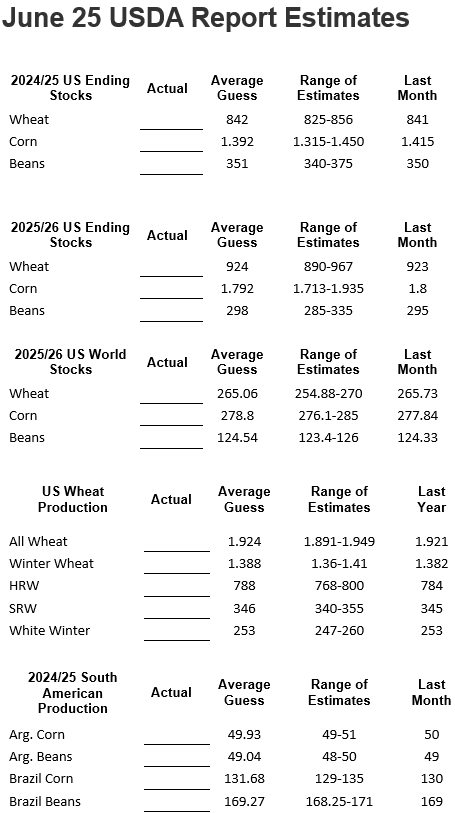

- 24/25 US Corn Stocks: 1.540 BBU (1.526 BBU Estimate)

- 24/25 World Corn Stocks: 290.3 MMT (292.52 MMT Estimate)

- 24/25 Brazil Corn Prod: 126 MMT (126.74 Estimate)

- 24/25 Argentina Corn Prod: 50 MMT (50.49 Estimate)

- 24/25 US Bean Stocks: 380 MBU (374 MBU Estimate)

- 24/25 World Bean Stocks: 124.3 MMT (127.79 MMT Estimate)

- 24/25 Brazil Bean Prod: 169 MMT (169.64 Estimate)

- 24/25 Argentina Bean Prod: 49 MMT (50.89 Estimate)

- 24/25 US Wheat Stocks: 794 MBU (799 MBU Estimate)

- 24/25 World Wheat Stocks: 257.6 MMT (258.6 MMT Estimate)

Current Trade

A Complete Overview of Current New Crop Market Conditions

Last Updated: 08/22/2025

- Corn Neutral Neut/Bullish Neut/Bullish Neut/Bullish Medium Sell Rallies

- Soybeans Bearish Neutral Neut/Bullish Neut/Bullish High Sell Rallies

- Wheat Bearish Neut/Bullish Neutral Neutral Medium Sell Rallies

- Cattle Neut/Bullish Neut/Bullish Neut/Bullish Neut/Bullish Medium Sell Rallies

- Hogs Bullish Neutral Neutral Neut/Bullish High Sell Rallies

- Diesel Bullish Neut/Bullish Neutral Neutral Medium None

- Denotes positive change

- Denotes negative change

Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. No market data or other information is warranted by Reliance Capital Markets II LLC as to completeness or accuracy, express or implied, and is subject to change without notice. Any comments or statements made herein do not necessarily reflect those of Reliance Capital Markets II LLC, or their respective subsidiaries, affiliates, officers or employees. Disclaimer: Past performance is not indicative of future results. Strategic Trading Advisors is a registered DBA of Reliance Capital Markets ll LLC.

About Jody Lawrence

Jody Lawrence has been in the commodity brokerage and agriculture marketing business since 1992 and started Strategic Trading Advisors in 1999 and runs it today with his son Brady. The daily market comment his company publishes has over 7000 subscribers in 33 states and 3 countries and provides a concise overview of the world markets with ideas on farm hedging and marketing. Jody also travels the country giving 60-70 marketing meetings a year through his 22-year strategic partnership with Helena Agri-Enterprises.